Go paper-free

Amend paper-free preferences for your statements and correspondence.

Get your money in motion with our Ready-Made Investments. Managed by experts and with lower ongoing fund charges, it’s a smart way to invest.

For existing Bank of Scotland customers only. It's easy to become a customer - open an account.

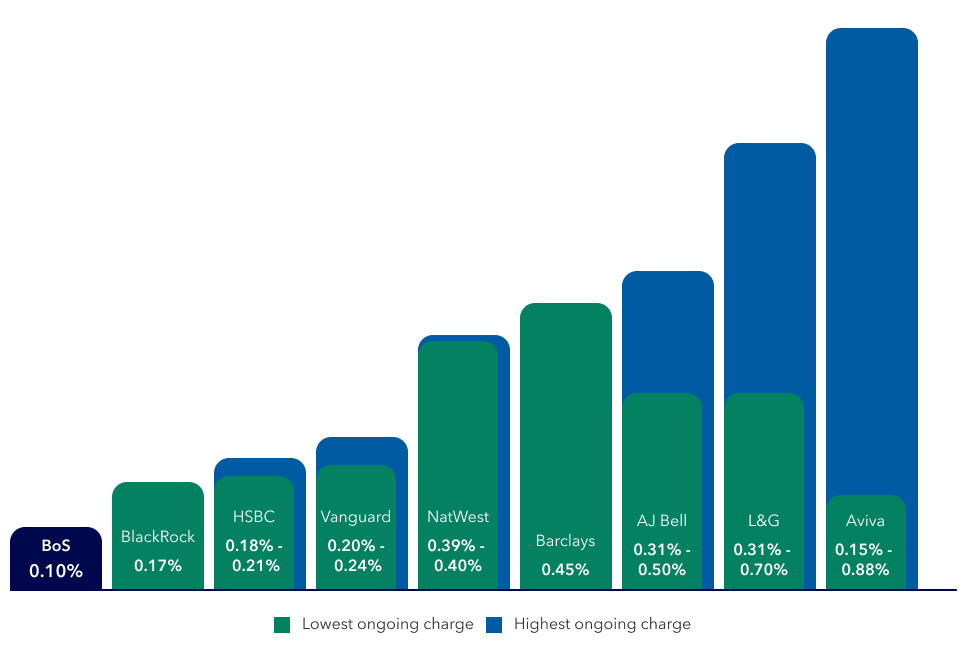

Our ongoing fund charges are some of the lowest on the market, so more of your money is invested.

This graph shows ongoing charges only - from a selection of comparable competitor’s fund offerings. Other account fees and charges also apply. We sourced the data from competitor websites, correct as of 10 February 2026.

|

Bank of Scotland - Ready-Made Investments |

0.10% |

|---|---|

|

BlackRock - MyMap |

0.17% |

|

HSBC - Global Strategy Portfolios |

0.18% - 0.21% |

|

Vanguard - Life Strategys |

0.20% - 0.24% |

|

NatWest - Invest |

0.39% - 0.40% |

|

Barclays - Ready-Made Investments |

0.45% |

|

AJ Bell - Growth, Responsible Growth and Income Funds |

0.31% - 0.50% |

|

L&G - Multi-Index Funds |

0.31% - 0.70% |

|

Aviva - Multi-Asset Funds |

0.15% - 0.88% |

Everyone wants their money to work harder for them, that’s why more and more of our customers are choosing Ready-Made Investments.

Our Ready-Made Investments contain investments picked by our experts helping take the worry and confusion away.

Video length 2 mins 17 secs.

You can pick from three options to best suit you – cautious, balanced or adventurous. And you can change this in the future if your circumstances or view of risk changes.

Open an Investment ISA, our tax-efficient way to start investing, or an Investment Account if you’ve already used your ISA allowance.

Everyone wants their money to work harder for them, that’s why more of our customers are choosing Ready-Made Investments.

Our Ready-Made Investments contain investments picked by our experts helping take the worry and confusion away.

Starting from £50 a month or £500 as a lump sum.

Keep in mind, investing in stocks and shares is a longer-term commitment and it is not a substitute for cash savings. We recommend you leave your money invested for around five years. You should still make sure you have 'rainy day' cash savings to cover unplanned expenses and emergencies. It's always worth regularly reviewing your goals.

Track and top up your ready-made portfolio using Internet Banking or our app. Just like your everyday banking.

Lower risk and steady returns are ideal for those who want to take less risk.

Mainly invests in bonds and has limited exposure to shares and property.

Charges

Account fee: £3 a month

Ongoing charge: 0.1%

Key documents

Moderate risk and growth potential.

Suitable for those who want a balance between risk and reward.

Invests in shares, bonds and property.

Charges

Account fee: £3 a month

Ongoing charge: 0.1%

Key documents

Designed for those willing to take more risk for higher returns.

Mainly invests in shares, with some bonds and alternative assets.

Charges

Account fee: £3 a month

Ongoing charge: 0.1%

Key documents

For more information about the three funds, read our fund range and investments guide (PDF, 261KB). This document provides details on how our charges work, including transaction costs and other charges. You can also learn more about risk and the investment process.

A £3 account fee also applies when buying and selling funds. The charges shown here do not include transaction costs. The fund’s performance may differ.

Investments are sold at a minimum value of £10. All remaining sales proceeds will be held as cash in your account after the £3 fee is paid. The cash will continue to accrue monthly fees.

The data in the below table and performance chart refer to the past, and past performance is not a reliable indicator of future results. The performance data includes the ongoing charge and all transaction costs within the fund, but does not include the £36 account fee.

Source of data: FE Fundinfo

The above graph shows the percentage change of the funds since launch. This is to help you understand how the funds have performed over the longer term.

Please remember that the data in the above performance graph and the below table refer to the past, and past performance is not a reliable indicator of future results.

The last available price for each fund is shown below the graph and this is usually the price from the previous trading day. If you decide to invest in one of our funds, your trade will be sent to the Fund Manager and you will get the price given on the next available valuation point for this fund, which could be higher or lower than the price shown above.

Remember that the data in this table refers to the past. Past performance is not a reliable indicator of future results.

|

Date |

Cautious |

Balanced |

Adventurous |

|---|---|---|---|

|

Date 30 December 2024 to 30 December 2025 |

Cautious 8.3% |

Balanced 11.6% |

Adventurous 16.2% |

|

Date 30 December 2023 to 30 December 2024 |

Cautious 5.9% |

Balanced 9.4% |

Adventurous 12.6% |

|

Date 30 December 2022 to 30 December 2023 |

Cautious 8.6% |

Balanced 9.9% |

Adventurous 11.0% |

|

Date 30 December 2021 to 30 December 2022 |

Cautious -12.3% |

Balanced -8.9% |

Adventurous -7.0% |

|

Date 30 December 2020 to 30 December 2021 |

Cautious 3.5% |

Balanced 8.2% |

Adventurous 12.5% |

There is a flat-rate account fee of £3 a month.

Ongoing charge and transaction costs are calculated on an ongoing basis and built into the value of the fund.

|

If your investment was worth |

Cautious |

Balanced |

Adventurous |

|---|---|---|---|

|

If your investment was worth £1,000 |

Cautious £38.30 |

Balanced £38.60 |

Adventurous £38.60 |

|

If your investment was worth £5,000 |

Cautious £47.50 |

Balanced £49.00 |

Adventurous £49.00 |

|

If your investment was worth £10,000 |

Cautious £59.00 |

Balanced £62.00 |

Adventurous £62.00 |

|

If your investment was worth £20,000 |

Cautious £82.00 |

Balanced £88.00 |

Adventurous £88.00 |

A fund is a collection of assets created by investment experts (Fund Managers). These can be made up of shares, bonds, property or even cash.

Investing in a fund with a wide range of assets could offer potential growth over time, while also helping to reduce any risk.

Make sure you’ve read the terms and conditions (PDF, 217KB) and relevant key features document:

Key features document Investment ISA (PDF, 145KB)

Key features document Investment Account (PDF, 137KB).

To apply, you must:

Want to start investing but not a Bank of Scotland customer yet?

Get started with one of our accounts.

We’ve created a simple five-step guide to help you decide if investing works for you.

Understanding risk and reward is crucial to investing. Read our article to learn more.

We have a range of easy-to-read content to grow your confidence in investing.

You can review your account by Logging in or view your charges on our Online Investments page.

Ready-Made Investments are provided by Embark Investment Services Limited, a company incorporated in England and Wales (company number 09955930) with its registered office at 33 Old Broad Street, London, EC2N 1HZ. Embark Investment Services Limited is authorised and regulated by the Financial Conduct Authority (Financial Services Register number 737356).