Go paper-free

Amend paper-free preferences for your statements and correspondence.

If you’re looking for support with budgeting, we’re by your side. Our budgeting tools and tips will give you the confidence to manage your money better.

We'll cover:

Consider setting up separate accounts for different types of spending. For example, you could have a ‘bills’ account for everything you need to pay in a month and a ‘spending’ account for the rest. Managing bills can be stressful, but with some help you can gain control of your payments.

Use our easy saving tips to help you reach your goals, reduce your spending and develop some new saving habits along the way. Use our savings calculator to reach your target or work out the future value of your savings

Break down larger costs into smaller payments to make them easier to manage. Paying smaller amounts by Direct Debit each month is a more manageable way to pay for larger bills, such as car insurance and your TV licence fee.

Keeping track of your income and spending can be difficult to manage sometimes. Our free budget tool gives you a full overview of what’s coming in and going out each month.

Keeping on top of your income and outgoings can really help. We have many tools available in Internet Banking and on our Mobile Banking app to help you. The following guides show how you can access these tools and be smarter with your money.

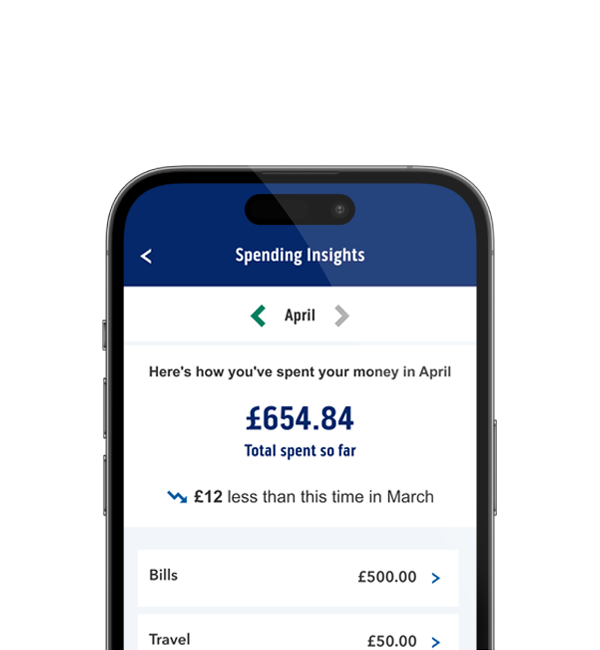

Get a full overview of your money using our Spending Insights tool. It shows your current account spending in categories so you can spot any patterns and see where you might be able to save money.