Go paper-free

Amend paper-free preferences for your statements and correspondence.

Personal financial advice to give you the opportunities, the life and the future you and your family deserve.

|

Date |

Cautious Portfolio |

Balanced Portfolio |

Cash |

Inflation |

|---|---|---|---|---|

|

Date 31 Aug 2020 to 31 Aug 2021 |

Cautious Portfolio 9.37% |

Balanced Portfolio 16.44% |

Cash 0.05% |

Inflation 3.20% |

|

Date 31 Aug 2021 to 31 Aug 2022 |

Cautious Portfolio -9.43% |

Balanced Portfolio -5.18% |

Cash 0.58% |

Inflation 9.87% |

|

Date 31 Aug 2022 to 31 Aug 2023 |

Cautious Portfolio -0.05% |

Balanced Portfolio 1.37% |

Cash 3.71% |

Inflation 6.66% |

|

Date 31 Aug 2023 to 31 Aug 2024 |

Cautious Portfolio 9.04% |

Balanced Portfolio 11.28% |

Cash 5.17% |

Inflation 2.22% |

|

Date 31 Aug 2024 to 31 Aug 2025 |

Cautious Portfolio 6.03% |

Balanced Portfolio 8.77% |

Cash 4.50% |

Inflation 3.79% |

|

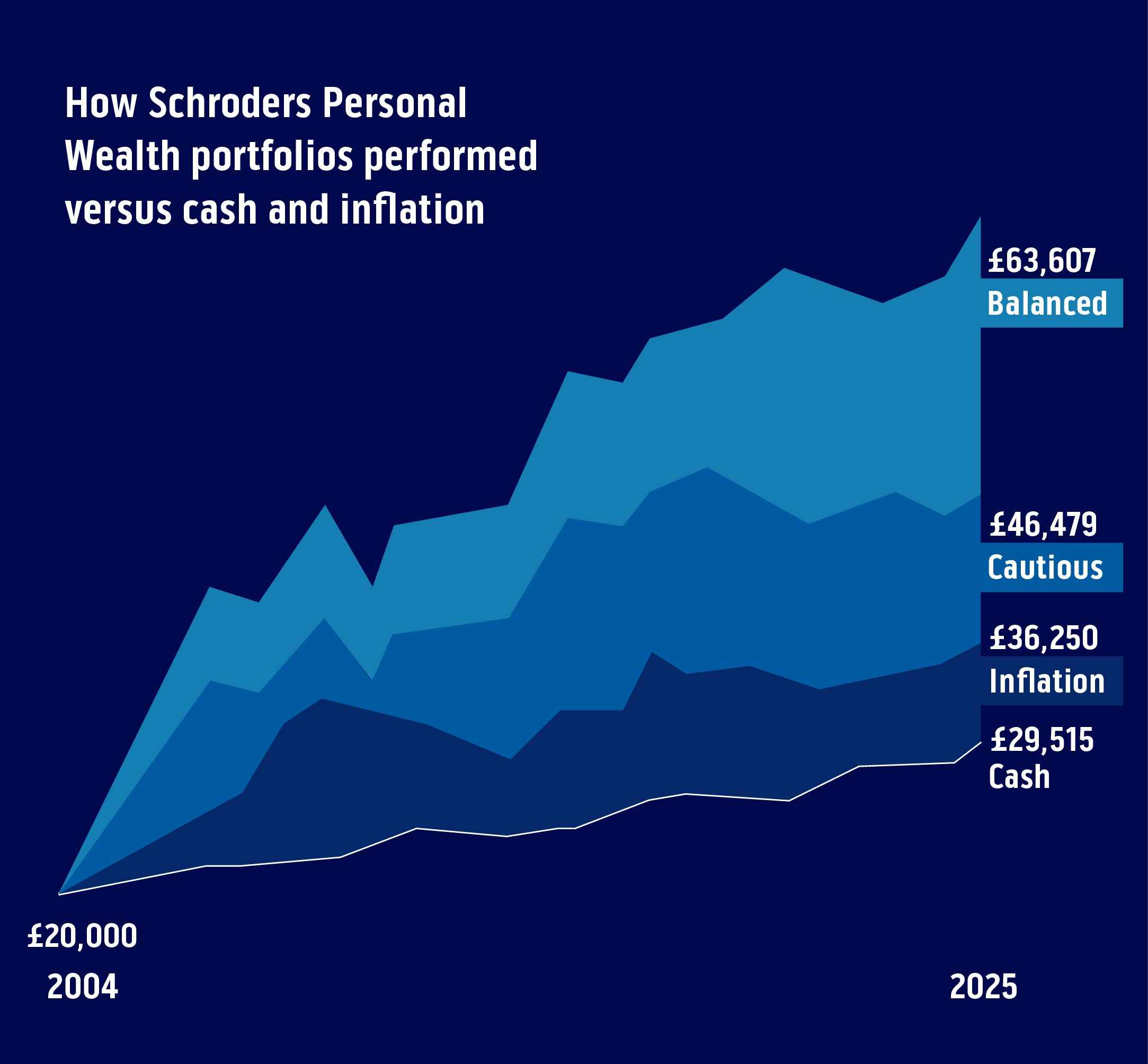

Date 31 Oct 2004 to 31 Aug 2025 |

Cautious Portfolio 132.39% |

Balanced Portfolio 218.03% |

Cash 47.58% |

Inflation 81.25% |

Source: FactSet, Schroders Personal Wealth, 31 August 2025. PDPS performance prior to 1 June 2019 reflects the Investment Portfolio Service managed by Lloyds Bank PLC. Returns are net of underlying fund fees and charges and gross of SPW fees. Cash is represented by SONIA Overnight rates; Inflation is represented by the Retail Prices Index (RPI).

These figures refer to the past and the past performance is not a reliable indicator of future results.

|

Investment type |

Performance by 2025 |

|---|---|

|

Investment type Balanced |

Performance by 2025 £63,607 |

|

Investment type Cautious |

Performance by 2025 £46,479 |

|

Investment type Inflation |

Performance by 2025 £36,250 |

|

Investment type Cash |

Performance by 2025 £29,515 |

Schroders Personal wealth has been awarded a 4.8 “Excellent” rating for the quality of services they provide.

Based on 1,609 reviews on Trustpilot as of October 2025.

Schroders Personal Wealth is a now a fully owned subsidiary of Lloyds Banking Group and over the coming months, will transition to become Lloyds Wealth.

Protect yourself against inflation and explore ways to minimise taxes.

By investing, you can pave the way towards financial growth and stability.

Illness, injury or loss of income can impact you and your family.

The right plan can give you peace of mind and give support if the worst should happen.

Make future plans and help ensure that you have the financial freedom to enjoy them.

If you’re retired or will be soon, see how we can help make the most of the funds you have.

Pass on your wealth in the way you intend by taking full advantage of the tax opportunities available.

The value of investments and income from them can fall as well as rise and are not guaranteed. The investor might not get back their initial investment. Tax treatment depends on individual circumstances and may change in the future.

Discover more about Schroders Personal Wealth in this introduction video. Learn how Schroders can bring you from where you are now to where you want to be.

When considering financial advice, explore our articles to help you make an informed decision

Your call may be monitored or recorded. Call costs may vary depending on your service provider.

Schroders Personal Wealth is a trading name for Scottish Widows Schroder Personal Wealth Limited. Registered Office: 25 Gresham Street, London EC2V 7HN. Registered in England and Wales No 11722983. Authorised and regulated by the Financial Conduct Authority.