Go paper-free

Amend paper-free preferences for your statements and correspondence.

Co-servicing allows you to manage all your accounts in one place.

To make banking easier and more convenient, we’ve started to introduce more ways you can manage any personal accounts you have with Bank of Scotland, Halifax or Lloyds in one place, using co-servicing. Whether that’s online through the apps and online banking, or with a colleague over the phone, or in a branch.

View any Bank of Scotland, Lloyds or Halifax personal accounts in one place, giving you a fuller picture of your finances.

You can complete a number of everyday tasks with your Lloyds and Halifax accounts too.

You'll need to keep all your apps so you can approve purchases made online, receive notifications and open new accounts.

Getting the most out of having all your accounts together.

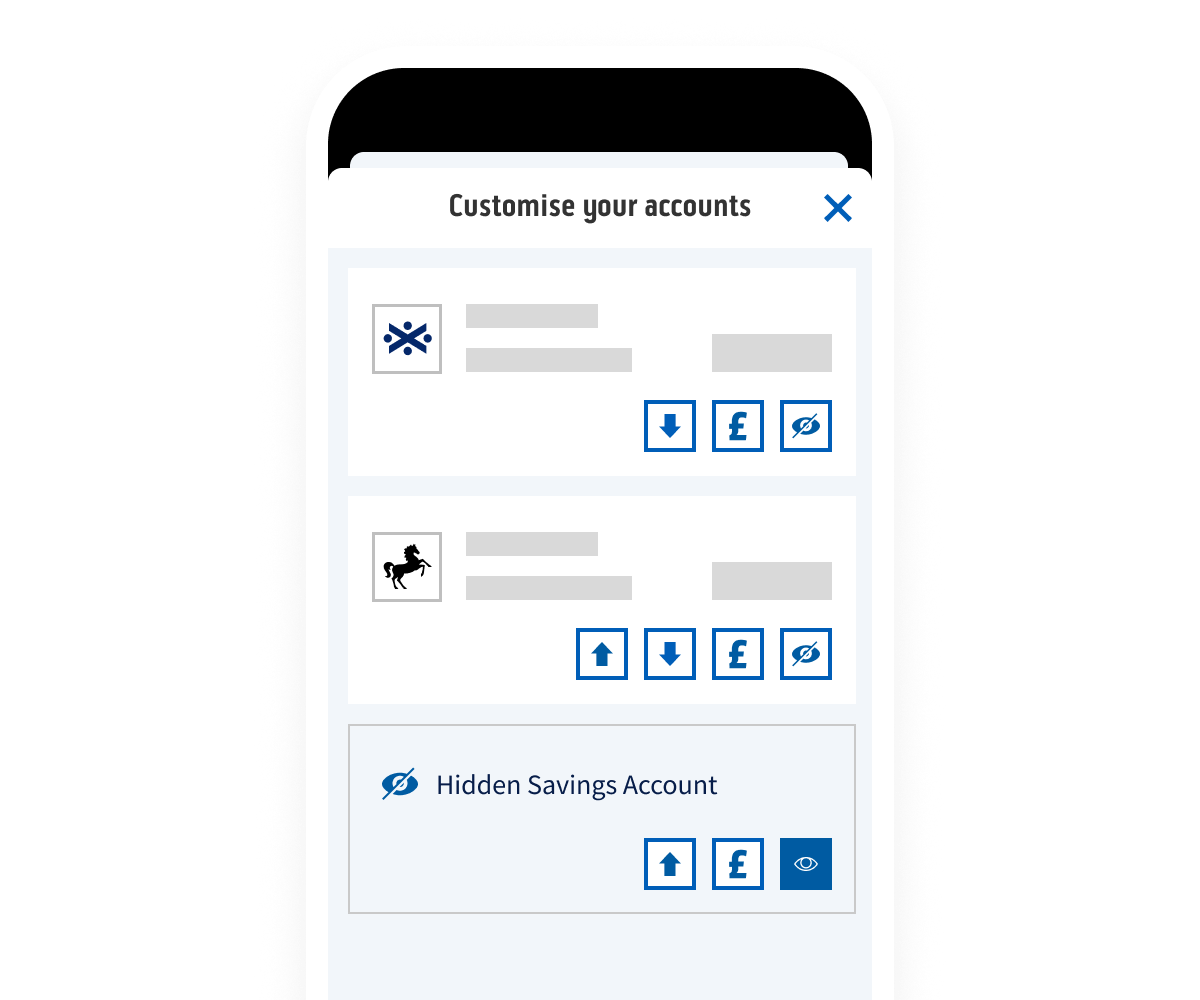

Your summary space is all about you. Choose which accounts you want to see, hide the ones you don’t, and arrange them in the order that works best for you. You can easily bring them back whenever you like. Accounts you’ve hidden in your summary space will still show up in other spaces in the app.

If an account has popped up that you haven’t used in a while, you can start using it again or close it if you prefer. If it’s an old account, you may need to reactivate it. Select the account in the app or online banking and follow the instructions. Or message us in the app and we’ll explain what to do. We’re here for you 24/7.

Need help? If something doesn’t look right or you need a hand, message us in the app anytime. We’re happy to help.

You can already visit the branch that’s most convenient to you to manage your accounts.

Pay in a cheque, update your details or chat to us, wherever you are.

Calls may be monitored and recorded. Not all Telephone Banking services are available 24 hours a day, seven days a week.