Go paper-free

Amend paper-free preferences for your statements and correspondence.

We are unable to cancel a payment once it’s been made.

Bank of Scotland will never ask you to:

We'll take it step by step.

(1 min 59 secs)

If you're not registered for Internet Banking, you can visit us in branch or call us.

We will always have lower payment limits when you call us.

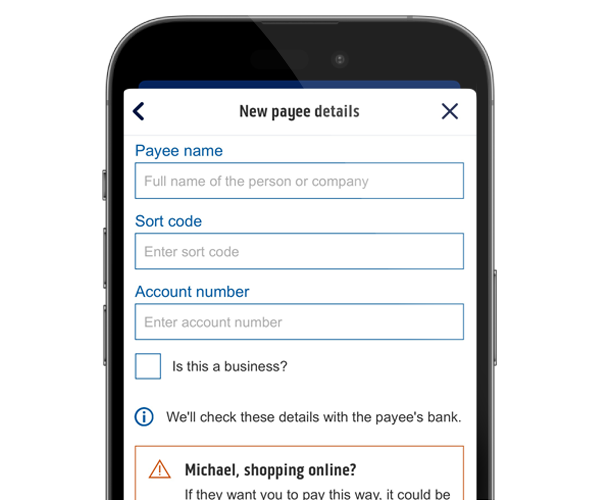

Confirmation of Payee (CoP) is an account name checking service to help you make sure your payment goes to the right place.

These checks are designed to help stop payments going to the wrong account by spotting possible mistakes and adding extra security steps to prevent fraud.

How CoP helps you make payments with confidence

The CoP service has been introduced across the banking industry as an extra way to help tackle fraud and keep customers’ money safe.

The service helps make sure payments go to the right account by checking the name and account details all match before a payment is sent. This reduces the risk of making a mistake and paying the wrong person and can help to avoid payment scams.

You need to be careful when you make a payment online. Fraudsters can pretend to be someone you trust or offer things like fake goods to try and scam you.

We’ll do as much as we can to protect you and reduce scams while you make genuine payments.

To stay safe online, we have a code of conduct that can help to avoid Authorised Push Payment scams.

This code will help to protect you from scams and give you the chance of a fraud refund.

When asking what your payment is, for we can use our advanced systems to help us to fight fraud. We can use them to warn you about a scam before you make a payment and when you set up a new recipient or change an existing one.

If you get a warning, make sure you take suitable action to protect your payment. We may not refund your money if you ignore a warning and fail to act.

First, check your account to see if the money has already been returned.

If it has, you can resend the payment with the right details.

If it hasn’t and you know the recipient, the easiest and quickest way to get your money back is to contact them directly.

If you don’t know them, if you don’t want to contact them or if the account you paid is closed, call us.

We’ll try to recover the money for you. Please be aware that we may not be able to help you. In that case you‘ll need to contact the bank you made the payment to.