Go paper-free

Amend paper-free preferences for your statements and correspondence.

There are some types of cheque that you can't pay in with the app. The app will let you know if this happens.

We'll take it step by step.

(2 min 33 secs)

To see how to do this, watch our video (2 min 33 secs).

If you're not registered for Internet Banking, you can call us. If you prefer to bank in person, there’s a range of services in your local area.

You can also pay in a cheque by post.

You can check the Deposit History tab at any time to see when your money will be available. Here you can view all cheques you've paid in using the app over the last 99 days.

The Deposit History tab won’t show any cheques you've paid in at a branch or a Cashpoint®.

If you have a joint account, it also won't include any cheques paid in by the other person using another mobile device. You'll see a total of all paid-in cheques in your account details. They're shown as a pending transaction first, until the money is available.

If a cheque in Deposit History says 'Rejected', we were unable to process the payment. Don't try to pay it in again in the app. The reason for rejection will display in your Deposit History, and we'll also write to you to confirm this reason.

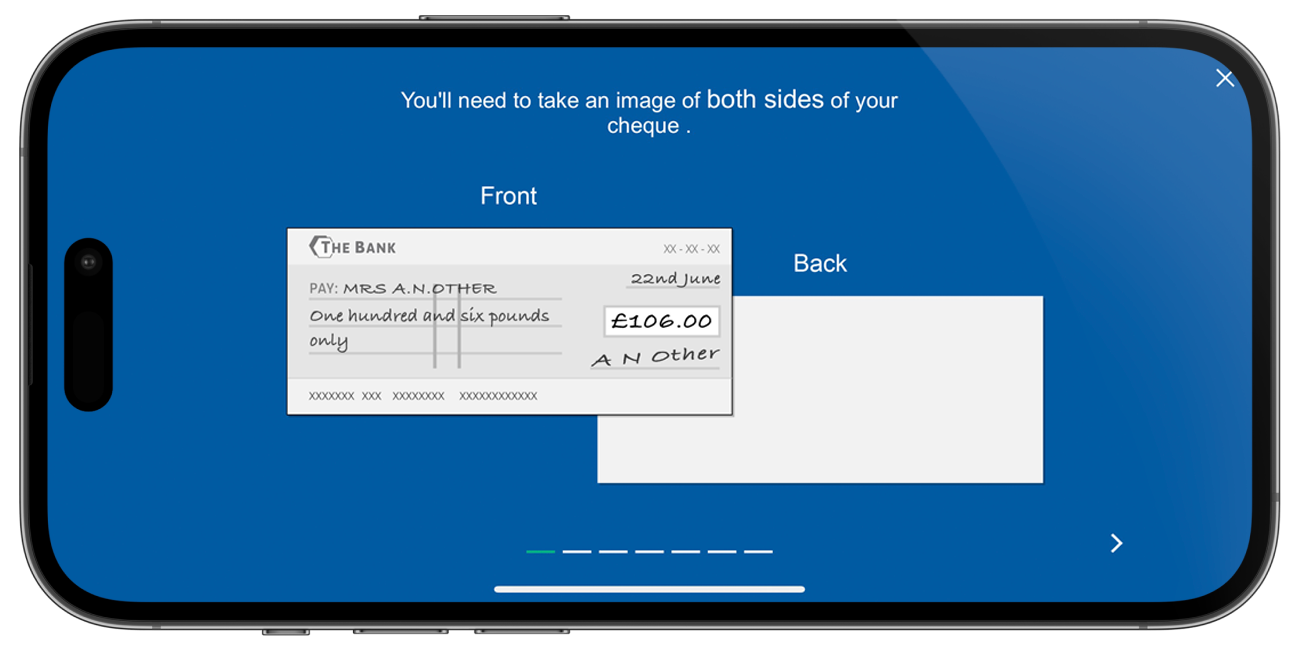

The app needs a good sharp image to 'read' the details. Place the cheque flat and in good light against a plain, darker background. Hold your device in the landscape position, steadily over the cheque without tilting. Hold still for a few seconds while the app takes the image – and it should now work.

No. For security, cheque images aren't stored in the app. They won't appear in your device's photo library or any cloud service connected with it. Cheque images are only stored securely on bank systems. Similarly, you can't upload cheque images from your device's photo library, or use a photocopy of a cheque.

In-app cheque deposits aren't available for travellers' cheques, Bank Giro credits, foreign currencies and other types of non-standard cheques.

You can pay in cheques written in English, Welsh and Gaelic. The recipient name can be in any language as long as it matches the account name.

It’s a way to pay in cheques using your mobile or tablet device using our Mobile Banking app. The app uses your device's camera to take a photo of the cheque. Then it ‘reads’ the details to pay the money into your account.

If you cannot use the mobile banking app, you can pay a cheque into your personal current account or savings account by post.

You can post your cheque to us in 2 ways. Write your sort code and account number on the back of the cheque, place it in an envelope and choose from the following options.

Once we receive your cheque, the money should reach your account within 2 working days.

If you posted a cheque to us more than 10 working days ago and haven’t seen the money in your account, contact us.

We need the following: