Go paper-free

Amend paper-free preferences for your statements and correspondence.

Navigating stock market downturns

It’s natural to think twice about your investments. You might ask yourself, “Should I be doing something different?” But before making any big decisions, take a moment to reflect on 6 tried-and-tested principles. They’re here to help you stay steady, confident and focused - no matter what the market throws your way.

Download the graph that shows the S&P World Index growth from 1995 to 2025 PDF(608KB)

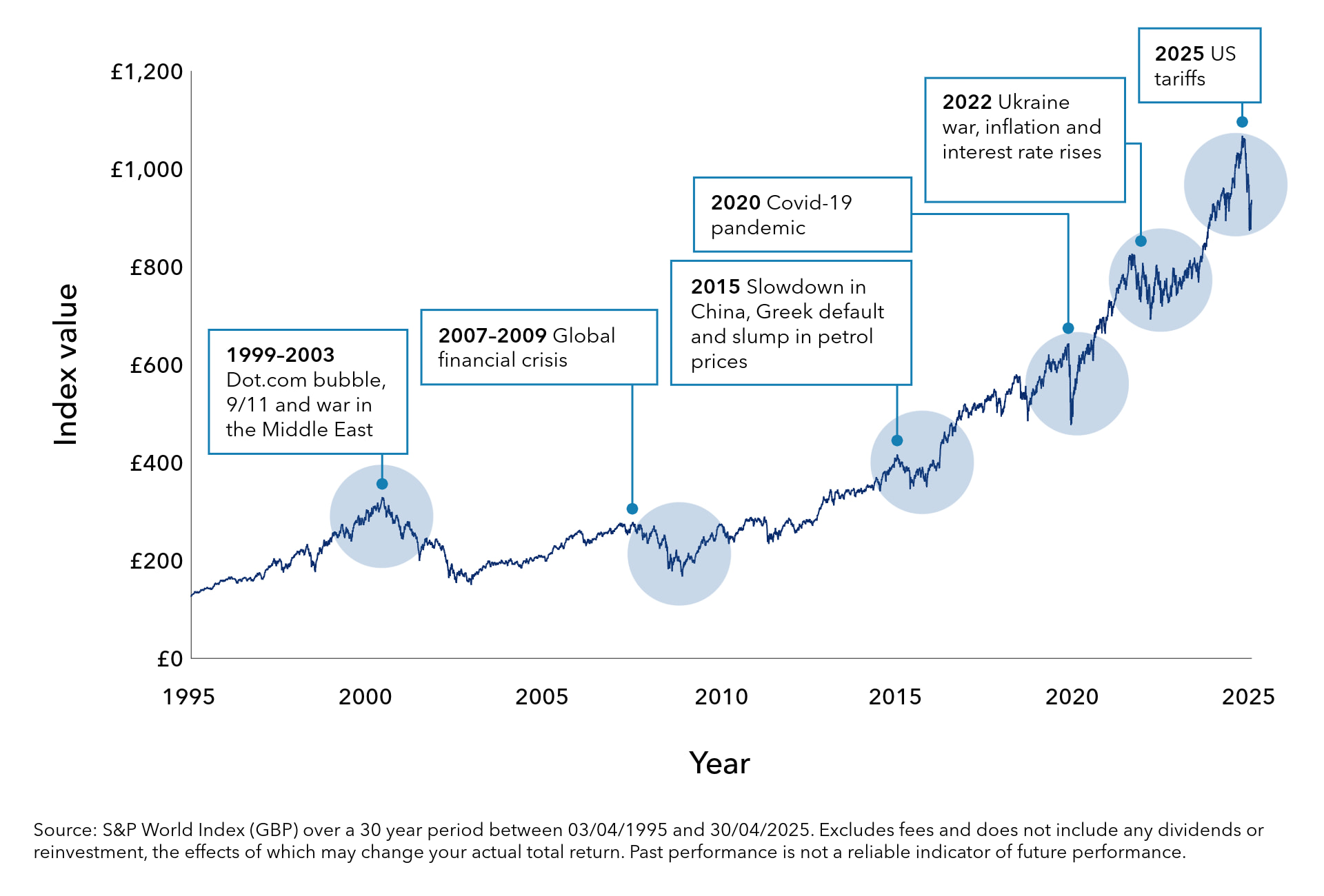

This chart shows the S&P World Index (GBP) from 1995 to 2025. The index starts at about £125 in 1995 and ends just above £930 in 2025. Over these 30 years, the index generally rises, but there are several periods where it falls due to global events.

Key events and their impact

Summary:

The S&P World Index (GBP) shows long-term growth from 1995 to 2025, with several short-term declines caused by major world events.

Understanding risk and reward is crucial to investing. Read our article to learn more.

Look for your next investment with our range of tools to find out more about Stocks, Funds, ETFs (Exchange Traded Funds) and Investment Trusts.

We’ve created a simple five-step guide to help you decide if investing works for you.

Bank of Scotland Share Dealing Service is operated by Halifax Share Dealing Limited. Registered in England and Wales No. 3195646. Registered Office: Trinity Road, Halifax, West Yorkshire HX1 2RG. Authorised and regulated by the Financial Conduct Authority under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.