Go paper-free

Amend paper-free preferences for your statements and correspondence.

Are you making unplanned purchases? Is your shopping out of control?

If your spending habits are preventing you from reaching your goals, we're by your side with some tips and tools that can help.

We have a step-by-step plan to reduce your spending.

Get started by using our budget calculator to understand your income and spending. Avoid spending unnecessarily by setting a contactless limit, deleting any apps that tempt you and blocking notifications from shops.

Our budgeting tips page also has lots of useful guides so that you can make a plan today and start planning for your future.

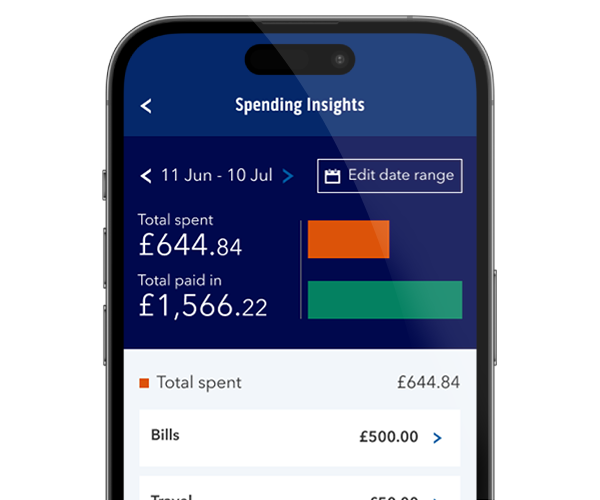

Take control with our spending insights app and track where your money goes each month. Our app notifications can send you a summary of what you’ve spent on your debit card each week and alert you when you’ve used your debit card. You can also quickly freeze and unfreeze different types of transactions, like to gambling sites to instantly block payments to gambling retailers.

You can also get advice on how to make your credit card work for you as well as understanding the cost of borrowing, including interest, fees and charges.

It’s easy to subscribe to something and forget that you’re still paying for it. You can review and manage all your subscriptions online as well as finding some great tips to help keep you in control.

We’re by your side to help you understand your borrowing and how to reduce the cost of your credit. You can start by checking your credit score for free with no impact to your credit file.

We’ll help you to understand your credit and what you can do to improve. We’ll send you updates if your score changes, letting you know what you’re doing well, as well as tips on things to work on.

Our savings calculators can help set a realistic savings goal. We have guides to support you to make a savings habit that might just replace your spending.

There are other organisations that can help you with your spending habits.

StepChange offer straightforward, free and impartial advice for you and your finances. We’ve also partnered with PayPlan who have specialists to go through your monthly income and outgoings to see what options there are for getting your finances under control.

Mental Health and Money Advice can help you to understand the links between mental health and money, how it might affect you and what the impacts might be.