Go paper-free

Amend paper-free preferences for your statements and correspondence.

Make the most of your ISA allowance - top up today

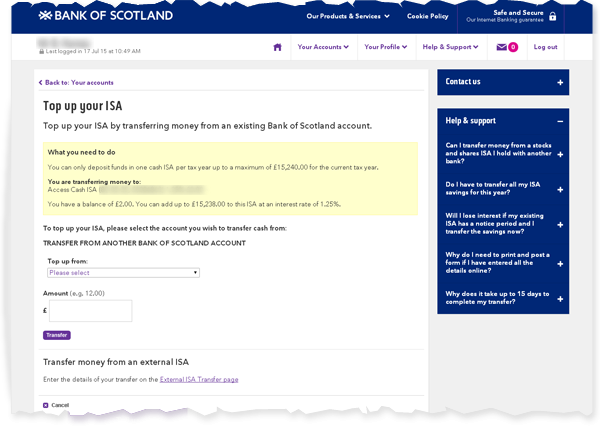

To maximise the tax-free benefit of your Access Cash ISA you can either set up a regular payment, pay in a lump sum or top up as often as you like, up to the current tax year ISA limit.

We've recently improved our online process, making key information clearer, and giving you the ability to top up your account in just a few clicks.

You can save up to £200 a month into your Help to Buy: ISA. You can save money by setting up a standing order.

You can top up the Fixed Cash ISA up to the current tax year ISA limit, within 30 days of opening your account. If you opened your Fixed Cash ISA before 02 June 2025, you can top up to the current tax year within 60 days of opening your account.

Take a look at our quick tour below to familiarise yourself with the process, then log in to Internet Banking to top up your ISA.

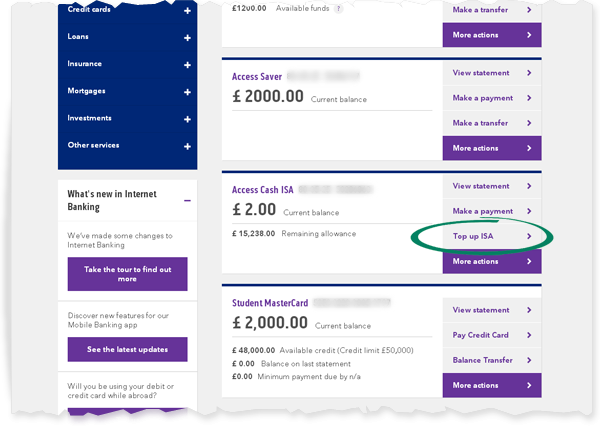

You can top up your ISA on your account homepage by selecting the ‘Top up’ button on your ISA product.

Your new top up page gives you two options:

Not yet registered for Internet Banking? Registering is easy and takes about 5 minutes. Find out how to register.