Go paper-free

Amend paper-free preferences for your statements and correspondence.

View your statement online in our mobile banking app or with online banking. Find out here about all the things you can find from your statement.

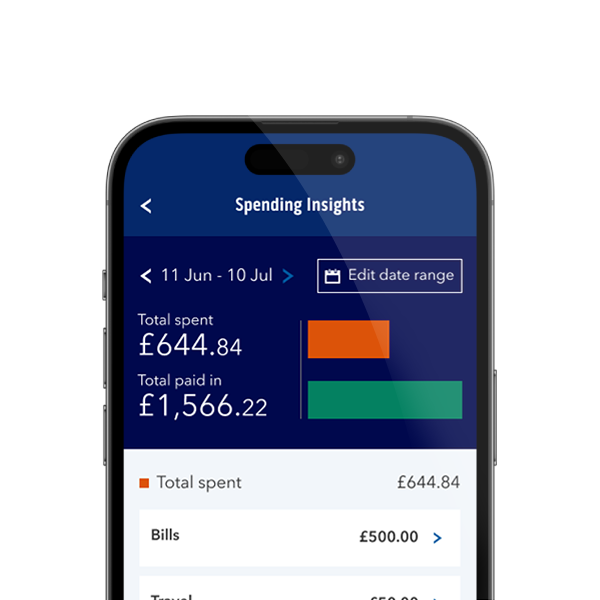

See your spending patterns with our quick and easy online tool.

See our useful tips to spot a transaction you don't recognise.