Go paper-free

Amend paper-free preferences for your statements and correspondence.

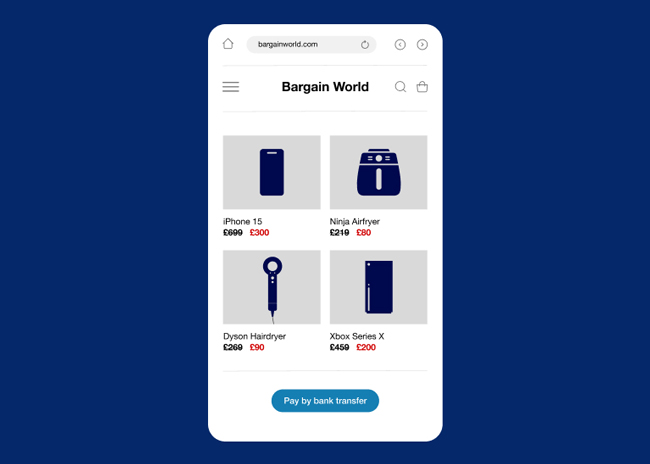

Found just what you’re looking for at a bargain price? It could be a scam.

We’ll help you spot the warning signs and learn how to avoid the fraudsters.

Fraudsters offer items that are fake or don’t exist and may make you feel rushed into a decision by telling you someone else is interested.

If something looks too-good-to-be true, it could be a scam.

This website looks professional but has lots of popular items at very low prices. It’s a scam. If you’re not sure about a website, you can use a website checker like the one on Get Safe Online.

It’s safer to pay more money to a company you know is genuine than risk paying a fraudster.

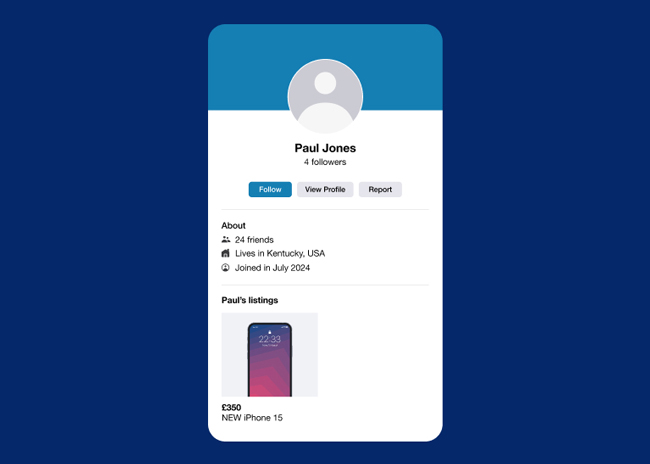

Fraudsters try to look like real sellers, with convincing social media profiles. They can fake pictures, reviews and even followers.

The best way to know if a seller is genuine is to see the item in person, especially if it’s local, large or expensive.